Armed Forces Bank has definitely become the pride of the US Government as it serves the former and current military people with the best of best banking services. If you want to know more about Armed Forces Bank, you will find out everything below:

Table of Contents

What is an Armed Forces Bank?

As the name suggests, “Armed Forces Bank” is a banking institution that remains in service for military members (current as well as retired) along with their respective families. To begin with, the first-ever Armed Forces Bank was established in 1907 by Dickinson Financial Corporation in Kansas, Missouri. Today, in 2021, there are over 15 branches of Armed Forces Bank spread all over the United States, which allows military people and their respective families to connect at a monetary level.

For the most part, armed forces or military people often remain at risk of losing their life on borders. Therefore, Armed Forces Bank acts as a closed box for the security of their monthly funds. Not only this, but if any military executive or force member is in need of a loan or hard cash, Armed Forces Bank remains 24 hours available to help.

Check out the following services provided by AFB to military people and their families:

Early Military Pay (only applicable for DFAS)

Under rare circumstances, if the Defense Accounting and Finance Services pay any military person an early military pay, Armed Forces Bank accepts it. It has different programs for this type of payment, including FrontWave Credit Union Advance Pay & Military Days and USAA Early Pay Dates.

However, it is noteworthy to mention that if a family member or a private organization requires to transfer money in a Military person’s account with Armed Forces Bank, early pay options remain inapplicable.

Credit Card Service

Military members can also apply for and acquire preferred credit card services from Armed Forces Bank, especially if they want to build a good credit score during their time in the Military. To begin with, the respective bank mainly offers Visa Credit Card and Credit Builder Card. To the reader’s surprise, this credit builder card holds the capacity of building credit anywhere between three hundred dollars and three grand.

Even if you retire from the Military later, your credit building card’s credit remains applicable for use anywhere in the world.

Different Types of Loans

Alongside common full-time banking services, AF Bank also remains approachable for retired as well as active military members in the time of need. From personal loans to mortgage and auto loans, the Armed Forces Banking institution remains at one’s service with very competitive interest rates.

In the context of Mortgage, a military member can choose between FHA Loans, VA Loans, or Conventional loans. However, all mortgage loans come with special conditions because the US military offers a heavy allowance for housing. Therefore, some loans are required to be paid via ½ portion of housing allowance.

Apart from this, any retired or active military member can apply for a personal loan as the need of the hour.

Accounts – Checking and Savings both

Apart from all the above-mentioned services, Armed Forces Bank also offers to check, and savings account services. This service allows military members to collect paychecks in savings accounts without having to maintain a minimum balance.

Other perks such as free-of-cost net banking and mobile banking services along with free-of-cost overdraft protection transfers remain available. To the reader’s surprise, Armed Forces Bank always remains ready to provide a debit card within 24 hours to the account holder. Hence, making it easy for military members to manage their finances.

What is the Armed Forces Bank Routing Number?

To begin with, RTN or Routing Transit Number is a unique code allocated to each bank in the United States by the American Bankers Association. This code is usually 9-digits long and remains crucial to enter if you want to make any wire transfer or direct deposit to or from your bank account. The same conditions also apply to Armed Forces Bank.

For the most part, Armed Forces Bank has only one routing number for all the branches. It is 101108319. Following are the top locations, address, routing number info, and phone details for all Armed Forces Bank in the area:

| Armed Forces Bank Branch Address | Routing Number | Contact Number | ZIP Code |

| 320 Kansas Ave, Fort Leavenworth, KS, United States | 101108319 | +19136829090 | 66027 |

| 2901 S 4th St, Leavenworth, KS, United States | 101108319 | +19133643730 | 66048 |

| 7840 Normandy Dr, Fort Riley, KS, United States (ATM/Kiosk) | 101108319 | +18889292265 | 66442 |

| 429 W 18th St, Junction City, KS, United States | 101108319 | +18164123507 | 66441 |

| 5303 Ashby Ave Bldg 5303, Fort Riley, KS, United States | 101108319 | +18164121814 | 66442 |

| 3452 Green Bay Rd, Great Lakes, IL, United States | 101108319 | +18474739750 | 60088 |

| 2260 Callagan Hwy Bldg 3379, San Diego, CA, United States | 101108319 | +16192393601 | 92136 |

| 37 Goldstone Rd, Fort Irwin, CA, United States | 101108319 | +17603861504 | 92310 |

| 550 Barnes Blvd, McChord AFB, WA, United States | 101108319 | +12535819272 | 98438 |

| Sijan Hall, 2348, Sijan Dr, Air Force Academy, CO, United States | 101108319 | +17194720213 | 80840 |

How to deposit cash into an Armed Forces Bank Account?

To begin with, Armed Forces Bank Rules & Regulations are made solely for the convenience of retired and active veterans and other military members. Therefore, you can deposit cash into your AFB Account at any Walmart premises. Check out the following instructions to do so:

- Take your debit card.

- Swipe the card in the machine at Walmart.

- Handover cash to the cashier.

- The cash deposit will reflect in your account within a few minutes.

Please note that Walmart acts as an intermediary in this scenario. Thus, there’s no risk involved. If you are still disquieted, you can ask the Walmart Cashier to verify his/her identity.

Apart from this, you can also plump to deposit funds into the respective bank account using mobile banking. In the event that the deposit is delayed, you will receive an email regarding the situation. Don’t worry! Your money will remain safe with the authorities.

Using Mobile App, you can deposit the following types of checks into the account:

- Business Checks

- Personally Acquired Checks (for example, while you move funds from one of your accounts to another).

- Treasury Checks or Checks provided by the Government (like pension checks or retirement checks).

- Cashier’s Check

Apart from this, while making a cash deposit in your Armed Forces Bank Account, please note that the check must belong to another US Bank. Also, a cash deposit or check deposit must be made in US currency, i.e.., Dollars. Other currencies are not accepted.

How to find my account number?

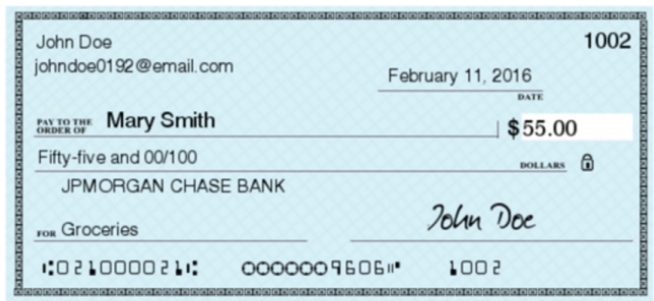

Method 1: Use Checkbook

Here are a few ways to locate your account number if you don’t recognize it:

- Take Armed Forces Bank Account Checkbook.

- Now, notice any check.

- At the bottom of the check, you will find three types of imprinted codes.

- The code at the very left is a 9-digit code called a routing number.

- In the middle, the 14-digit code is called your account number.

- And, at the right, the 3-digits code is your check number.

Please make sure that you observe the checkbook, which is associated with the bank account number you are looking for.

Method 2: Use Armed Forces Bank Money Transfer App

In the event that you cannot pin down your checkbook, you can use a digital banking app to check your account number belonging to Armed Forces Bank Account. Here’s how to do it:

- Open Money Transfer or Digital Banking App on your SmartPhone.

- Swipe left to open the main menu.

- Click on the “Accounts” option.

- Further, go to “Details.”

- In this section, you will find the account number and routing number.

How to transfer money from my AFB Account?

Again, there are different methods to transfer money from your AFB Account. One of the easiest methods is digital banking. Because AFB provides free-of-cost digital banking to each of its members. Thus, you can easily avoid any conveyance costs associated with offline money transfers. Let’s take a look at the instructions to do so:

- Log in to your AFB Mobile App using your username and password.

- Now, click on the “Transfer” or “transfer icon” given below.

- Further, “tick” or select the account from which you would like to debit the money.

- Next, enter the account number to which you want to credit the money.

- Next, enter the routing number that belongs to the receiver’s account.

- Now, double-check all the details and continue.

- Click on the confirm button if all the details are verified.

- Then, click on the “Submit” button to finally proceed with the transfer.

Conditions to know about AFB Bank

- The maximum ATM withdrawal limit for Armed Forces Bank users is anywhere between three hundred dollars and five grande per day.

- The maximum AFB Credit Builder Card limit is three thousand dollars.

- Also, the minimum deposit to open an account in Armed Forces Bank is $25, which you can withdraw later.

- Furthermore, For Business Interest Checking and Business Analyzed Checking Accounts, interest remains payable by the bank.

- Above all, $10.00 per month remains payable if you are using an account for services like Bill Pay.

FAQ:

Q: What is the Armed Forces Bank?

A: Armed Forces Bank is a full-service bank that serves active and retired military and civilians in all 50 states and around the world.

Q: What are the benefits of Access Rewards Checking?

A: Access Rewards Checking is a checking account that offers 5.35% APY* on a 15-month CD, 5¢ per gallon savings on gas at participating Shell Stations*, and other perks.

Q: How can I open an account with Armed Forces Bank?

A: You can open an account online, by phone, or by visiting a branch. You will need a valid ID, Social Security number, and a minimum opening deposit.

Q: How can I access my account online or on mobile?

A: You can access your account online or on mobile by logging in with your username and password. You can also use card controls, chat with Mili, and do other banking tasks.

Q: How can I contact the Armed Forces Bank?

A: You can contact Armed Forces Bank by phone, email, or mail. You can also find a branch or ATM near you on their website.

Epilogue

So, are you ready to enjoy your life after retirement from the Military? Have the courage. We are with you. For more information on Armed Forces Bank, leave your queries below. We are here for you.